Charge card financial debt can feel like a dark cloud that never ever stops following you. The consistent phone calls from enthusiasts, the installing interest, and the hopeless feeling every single time you consider your equilibrium-- it's overwhelming. Many people think they're stuck battling this fight alone, yet that's much from real.

A lawyer focusing on bank card financial debt can be a effective ally, supplying protection, experience, and a actual path towards monetary flexibility. Let's explore how they can help you reclaim control and take a breath much easier.

Why Charge Card Debt Really Feels So Frustrating

There's something distinctively demanding regarding charge card financial debt. Unlike a home mortgage or pupil loans, it really feels personal-- like a blunder that maintains growing. The rate of interest are penalizing, and on a monthly basis that you can't pay it off, it balloons also larger. The pity alone can maintain people from looking for aid, convincing them that they need to figure it out alone.

However the fact is that many people managing huge credit card financial obligation are hardworking, accountable individuals who got blindsided by life-- clinical emergency situations, job losses, or simply trying to make ends satisfy during tough times.

A legal representative for charge card debt doesn't simply bring lawful knowledge-- they bring a lifeline. They understand how the system functions, and much more importantly, they understand just how to protect you from it.

The Hidden Dangers of Ignoring Bank Card Financial Obligation

It's alluring to push those statements in a cabinet and act they do not exist. Yet neglecting charge card debt can result in a world of trouble-- suits, wage garnishments, and even frozen checking account. Financial obligation collectors know just how to press your switches, and they're relentless. Each call chips away at your satisfaction, making it harder to focus on job, family, or even sleep at night.

Here's where a legal representative makes all the distinction. The moment you have lawful depiction, those telephone calls have to stop. Collection agencies can't pester you directly-- they have to go through your legal representative. That alone is worth its weight in gold for your psychological health. More than that, a legal representative can challenge the legitimacy of your financial debt, bargain for reduced settlements, or perhaps obtain some of it erased completely if financial institutions broke the rules.

Just How a Attorney Can Shield Your Rights and Wallet

Most individuals don't understand they have legal rights when it involves credit card financial debt. Debt collection agency count on this lack of knowledge, utilizing scare tactics and confusion to stress payments. But a skilled attorney can subject these methods. Did the collection agencies supply correct documents? Did they call outdoors legal hours or make incorrect risks? These aren't simply minor infractions-- they can be premises to lower or disregard your financial debt.

A lawyer's first relocation is usually to verify the financial debt, requiring collection agencies to prove that they really have the right to accumulate it. You would certainly marvel how often they fail to do so. From there, your legal representative can discuss straight with bank card firms for minimized balances, lower rates of interest, or workable payment plans.

Financial debt Negotiation vs. Insolvency

When you're sinking in the red, it's easy to believe insolvency is the only way out. And occasionally, it's the appropriate phone call. Yet it's not the only alternative. A attorney can help you evaluate the pros and cons of financial obligation settlement versus personal bankruptcy based on your certain circumstance.

Financial obligation negotiation involves discussing with financial institutions to approve less than what you owe. It won't eliminate your financial debt overnight, but it can considerably decrease the total quantity and quit those crippling rate of interest. Bankruptcy, on the other hand, can provide you a fresh start however includes long-term effects for your credit report.

Recognizing the subtleties of these choices is crucial, and having a legal expert explain them can make all the difference.

The Power of a Custom-made Financial Debt Resolution Strategy

There's no one-size-fits-all service for bank card debt. That's why dealing with a attorney who can craft a debt resolution strategy tailored to your one-of-a-kind financial scenario is very useful. This strategy might consist of discussing reduced interest rates, challenging void financial obligations, or setting up a layaway plan that doesn't leave you picking in between grocery stores and your minimal settlement.

Via My Financial obligation Navigator, you can access a tailored strategy to financial debt relief that exceeds cookie-cutter advice. The objective is to equip you with a approach that not only addresses your existing financial debt but additionally safeguards your economic future.

Monitoring Your Progress and Building a Path Onward

Clearing debt isn't just about eliminating equilibriums-- it has to do with restoring your monetary wellness. Collaborating with a lawyer permits you to monitor your credit and economic progress systematically. Each progression, whether it's getting a financial obligation dismissed or setting up a reasonable payment plan, brings you closer to a future where bank card financial obligation isn't casting a shadow over your life.

This progress tracking isn't just a feel-good incentive; it's a essential part of staying determined and avoiding risks. When you can see your credit score inching up and your balances shrinking, it reinforces that the battle deserves it.

Finding Hope in the Middle of Financial obligation

It's very easy to feel hopeless when you're hidden in credit card financial debt. The numbers don't lie, and each declaration can seem like a type the intestine. However having a legal representative in your corner shifts the equilibrium of power. Rather than Calcium and Vitamin D for Menopause fearing the phone ringing, you can pass those phone call to a person that understands just how to manage them. Rather than presuming which financial obligations to pay first, you'll have a technique based on your civil liberties and your future.

This isn't about magic repairs or empty promises. It's about redeeming control, one action at once. By dealing with a attorney, you're not just resolving debt-- you're developing a path to financial flexibility that's legitimately audio and purposefully smart.

If you prepare to begin tackling your financial obligation with a strategy that's custom-built for you, take the first step with My Financial debt Navigator. Due to the fact that despite exactly how deep the hole might seem, there's a way out-- specifically when you're not climbing alone.

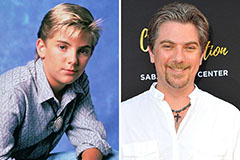

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Daryl Hannah Then & Now!

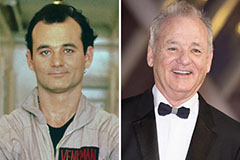

Daryl Hannah Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!